Financing a Shelby Raptor R is an exciting milestone — but it can feel overwhelming if you aren’t sure where to start. Whether you’re gearing up to buy your dream truck or just want a smarter way to manage the money side of things, this step‑by‑step guide helps Sterling drivers understand how to finance a Shelby Raptor R with confidence.

Step 1: Know What You Can Afford

Set Your Monthly Payment Budget

Before you begin looking at Shelby Raptor R pricing, figure out what monthly car payment fits comfortably in your budget. That means taking a hard look at your income, existing bills, and savings goals. A good rule of thumb is to keep your car payment under about 15% of your monthly take‑home pay.

Include All Ownership Costs

Don’t forget insurance, including the insurance company and policy details, as well as fuel, maintenance and seasonal expenses — especially with a high‑performance vehicle like a Raptor R. These ongoing costs matter just as much as the monthly payment.

Decide on a Down Payment Amount

A larger down payment lowers the amount you need to borrow and usually reduces your monthly payments. Aim for at least 10–20% down if possible — it strengthens your loan application and helps you build positive equity faster. Demonstrating your ability to make a substantial down payment also shows lenders your financial capability, which can further improve your chances of loan approval.

Step 2: Understand Your Credit & Loan Options

Check Your Credit Score

Your credit score has a big impact on your interest rate and loan approval terms. The higher your score, the lower your interest rate is likely to be — which means you pay less over time.

Get Pre‑Approved

Pre‑approval means you are preapproved by a lender, who reviews your finances before you choose a vehicle. It gives you a solid idea of what loan amounts and interest rates you qualify for — so you can shop more confidently. Being preapproved can also help you budget and negotiate more effectively when shopping for your Shelby Raptor R.

Compare Different Loan Offers

Don’t just accept the first offer you get. Compare financing from banks, credit unions and the dealership’s finance team. When evaluating offers, pay close attention to the annual percentage rate (APR) of each loan, as this rate directly affects your monthly payment and the total loan cost. Also, make sure you understand the loan amount and the total amount you will be borrowing, including any fees, taxes, or add-ons that may be included in the financing. Key factors that influence your monthly payment and overall cost include the APR, loan amount, and loan term. Sometimes small differences in these factors can save you a lot of money.

Step 3: Choose Your Loan Terms

Length of Loan Matters

Loan terms typically range from 36 to 72 months or more. Longer terms usually mean lower monthly payments — but you’ll pay more in interest over time. Shorter terms cost more each month but save you money overall.

Balance Monthly Payment and Total Interest

Choose terms that balance what you can afford each month with how much interest you’ll pay overall. A clear view of both short‑ and long‑term impact helps you make a smart decision.

Step 4: Consider a Trade‑In

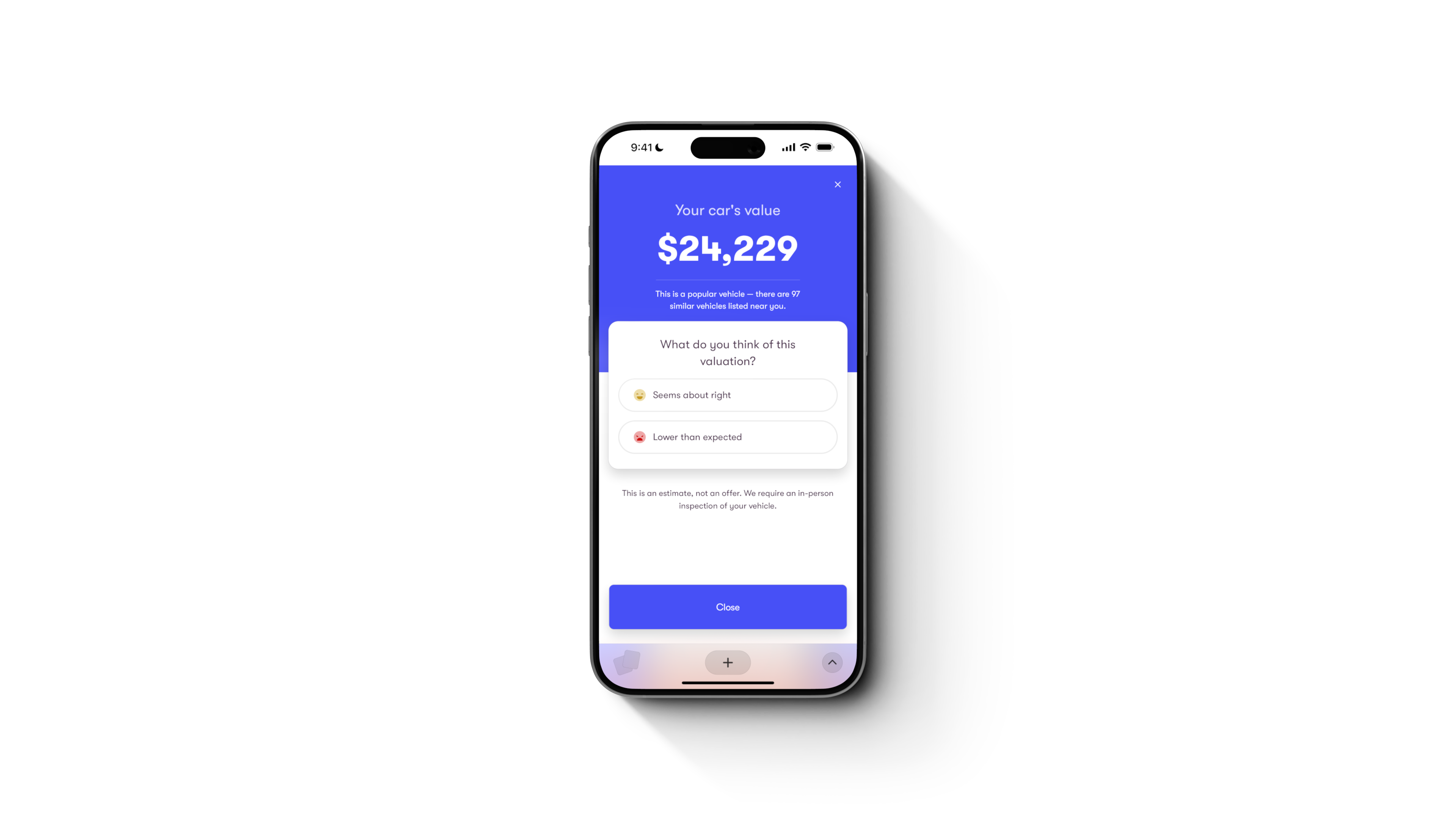

Use Your Current Vehicle’s Value

If you already own a car or truck, trading it in can significantly reduce what you need to finance. A strong trade‑in value can cover part of your down payment or help lower your monthly payments.

Get an Accurate Trade‑In Estimate

Ask your dealer to evaluate your vehicle’s condition and market value. A transparent trade‑in offer helps you plan your financing more precisely.

Step 5: Decide Between Buying and Leasing

Buying Means Ownership

Financing a Shelby Raptor R usually means you plan to own the truck once the loan is paid off. This gives you full equity and no mileage limits — great for drivers who plan to keep their vehicle long‑term.

Leasing for Lower Monthly Payments

Some buyers consider leasing because it can mean lower monthly payments. Leasing isn’t the same as financing — you don’t own the vehicle, and mileage or wear‑and‑tear limits may apply. For a high‑performance truck that many owners keep, financing tends to fit better.

Step 6: Finalize Your Financing

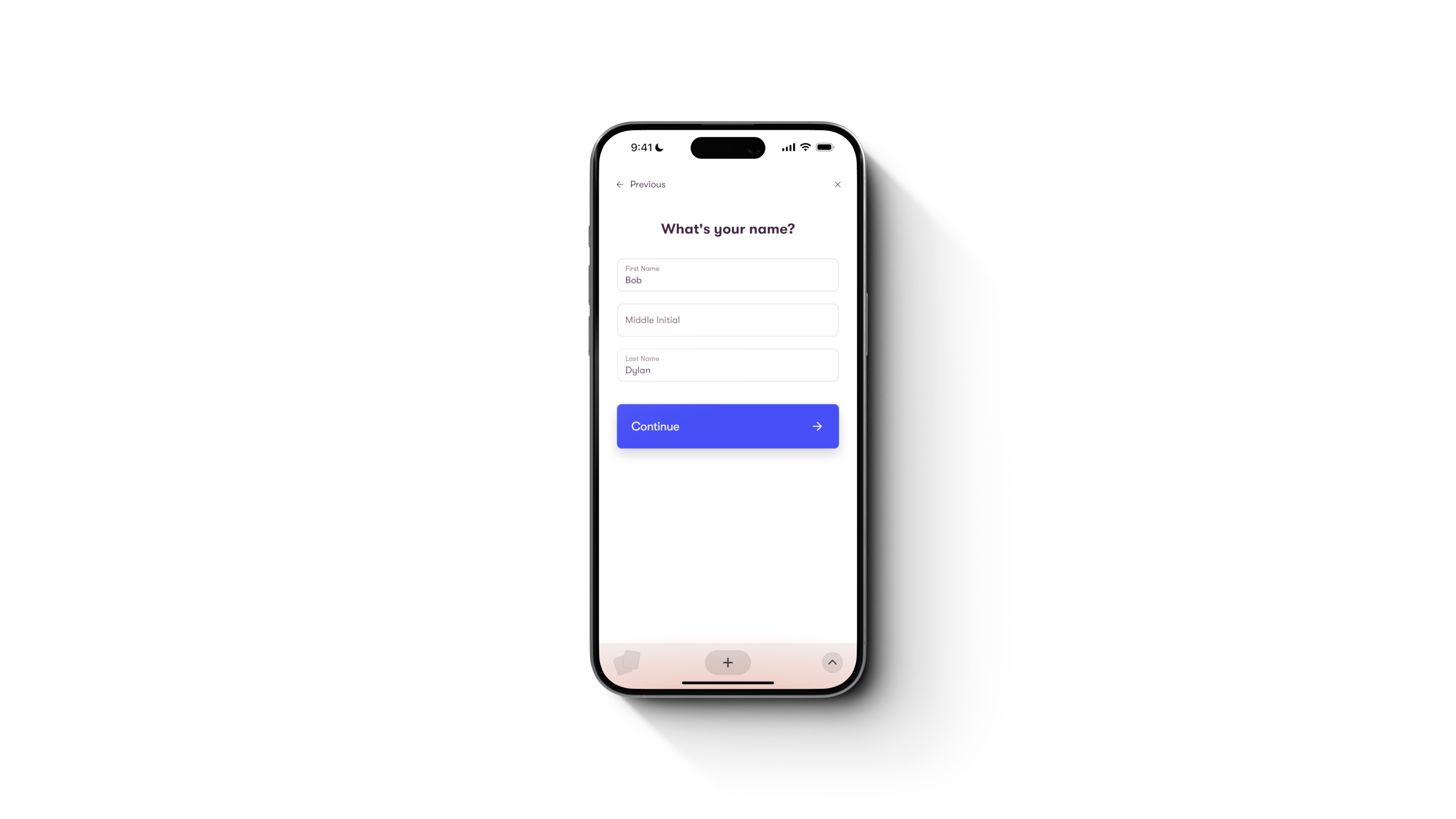

Prepare Your Documents

To speed things up, gather what lenders need:

- Valid driver’s license

- Proof of income (pay stubs, tax forms)

- Proof of residence

- Bank statements

- Insurance information

Having this in order makes approval smoother and faster.

Review the Loan Terms Carefully

Before you sign, check:

- Interest rate and APR

- Loan term length

- Monthly payment amount

- Fees or penalties

- Early payoff terms

Make sure everything matches what you agreed to — clear terms give peace of mind.

Ask Questions If Anything Is Unclear

There’s no such thing as a dumb question when it comes to your money. Ask about fees, add‑ons, warranty coverage, insurance costs or anything else you want to understand fully.

Tips for Sterling Drivers to Get Approved Faster

Be Honest on Your Application

Accurate information means fewer delays and faster processing.

Respond Quickly to Requests

If your lender asks for more documents, send them promptly — that keeps your approval moving.

Stay Within Your Budget

Don’t stretch for a monthly payment that feels too tight — a comfortable payment plan makes ownership more enjoyable.

Consider a Co‑Signer If Needed

If your credit history is thin or building, a co‑signer with strong credit can help you get approved faster and possibly at a better rate.

Final Thoughts

Financing a Shelby Raptor R doesn’t have to be intimidating. With a clear plan, a realistic budget and a step‑by‑step approach, Sterling drivers can navigate the process confidently and smoothly.

Conclusion

At Kunes Ford of Sterling, we work with drivers every day to help them finance vehicles — from everyday commuters to high‑performance Shelby Raptor Rs. By setting a budget, comparing offers, understanding terms and preparing paperwork, you’re setting yourself up for a successful, stress‑free financing experience. When you’re ready, we’re here to help you every step of the way.